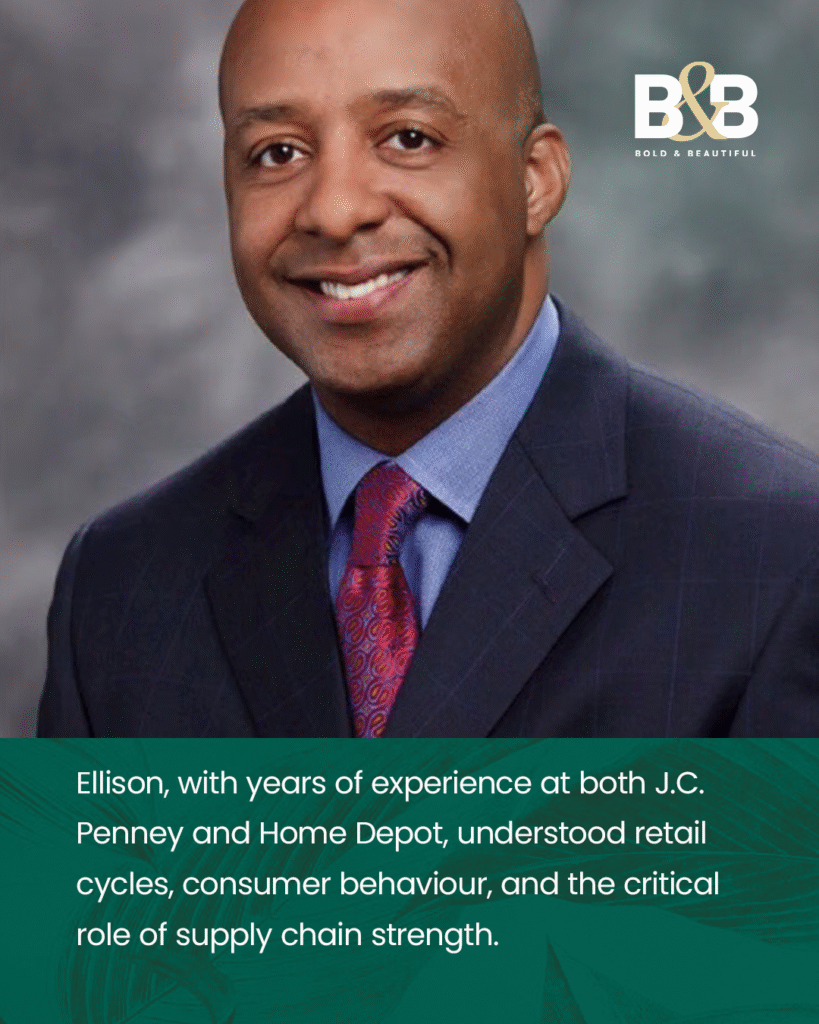

When Marvin Ellison took the reins at Lowe’s in 2018, he inherited a company lagging behind its closest rival, Home Depot. Analysts doubted whether Lowe’s could close the gap. But Ellison, with years of experience at both J.C. Penney and Home Depot, understood retail cycles, consumer behaviour, and the critical role of supply chain strength. His vision was clear: position Lowe’s not only as a retail giant but as a dependable partner for professionals driving America’s construction and housing markets.

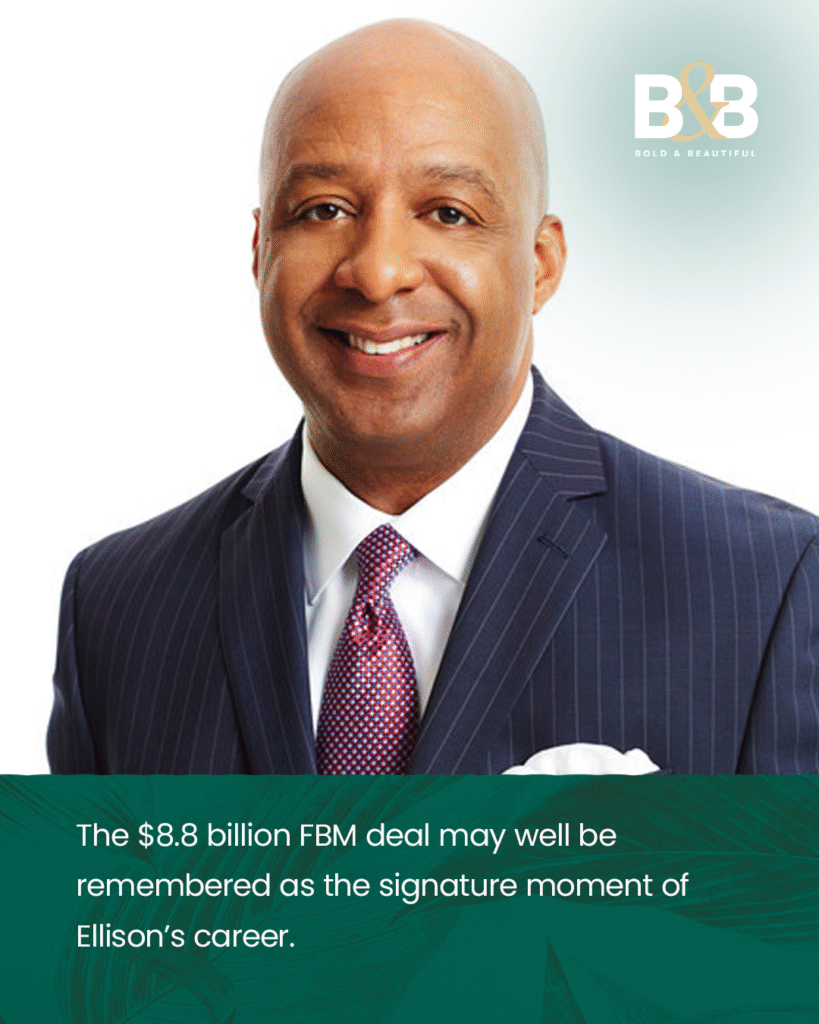

The $8.8 billion acquisition of Florida Building Materials (FBM) marked the boldest stroke of this vision. The deal, announced in 2024, immediately broadened Lowe’s access to professional customers by giving it control of one of the largest distributors of building materials across North America. For Ellison, it was not merely a purchase but an integration of supply chain and scale that secured Lowe’s place in the heart of America’s housing sector.

FBM came with a strong distribution network of over 270 locations, specialising in wallboard, steel framing, and complementary building products. By bringing it under the Lowe’s umbrella, Ellison effectively reshaped the company’s service to contractors, builders, and developers. The acquisition positioned Lowe’s as a one-stop solution, cutting down delivery times and giving professionals the reliability they demand.

Ellison’s move reflects a broader strategy he has implemented since joining Lowe’s: sharpen operations, streamline costs, and focus aggressively on professional customers. The pro segment accounts for a significant share of home improvement spending, yet Lowe’s historically underperformed in this area. With FBM now integrated, Lowe’s has gained both reach and credibility.

Industry observers see the FBM purchase as a turning point. It enhances Lowe’s ability to compete directly with Home Depot, while also insulating it from the volatility of DIY consumer spending. More importantly, it signals that Ellison is not afraid of large-scale moves that redefine Lowe’s trajectory.

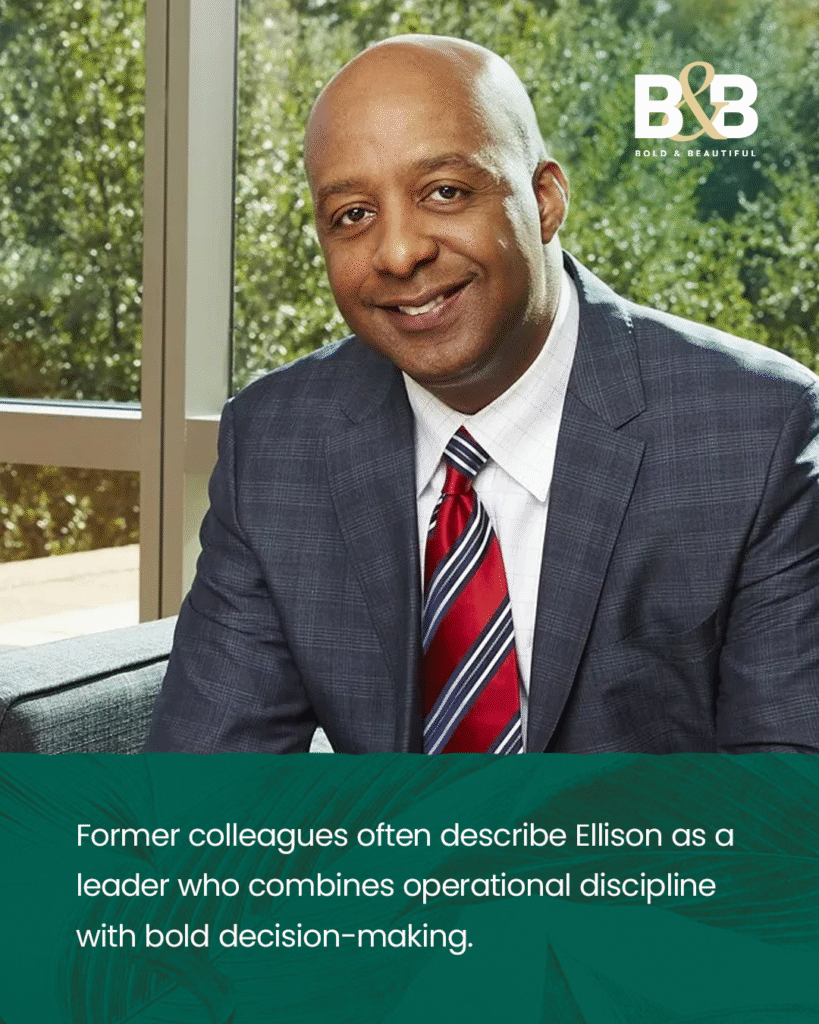

Behind the numbers lies Ellison’s leadership style. He is pragmatic, detail-driven, and relentless about execution. Former colleagues often describe him as a leader who combines operational discipline with bold decision-making. That balance is evident in how Lowe’s has steadily improved margins, tightened logistics, and boosted shareholder confidence under his tenure.

The $8.8 billion FBM deal may well be remembered as the signature moment of Ellison’s career. It transformed Lowe’s into a stronger competitor, anchored its position in the construction supply chain, and ensured that professional customers see the company as a long-term partner. For Lowe’s, the acquisition was not simply about expansion. It was about securing influence in the spaces where homes, offices, and skylines are built.

As the housing and construction industries continue to evolve, Ellison’s decision positions Lowe’s at the forefront of growth. The deal reflects his belief that true expansion requires more than store openings and product lines. It demands foresight, integration, and the courage to reshape a company’s place in the market.

3 comments

Somebody essentially lend a hand to make significantly articles Id state That is the very first time I frequented your website page and up to now I surprised with the research you made to make this actual submit amazing Wonderful task

I have read some excellent stuff here Definitely value bookmarking for revisiting I wonder how much effort you put to make the sort of excellent informative website

hiI like your writing so much share we be in contact more approximately your article on AOL I need a specialist in this area to resolve my problem Maybe that is you Looking ahead to see you