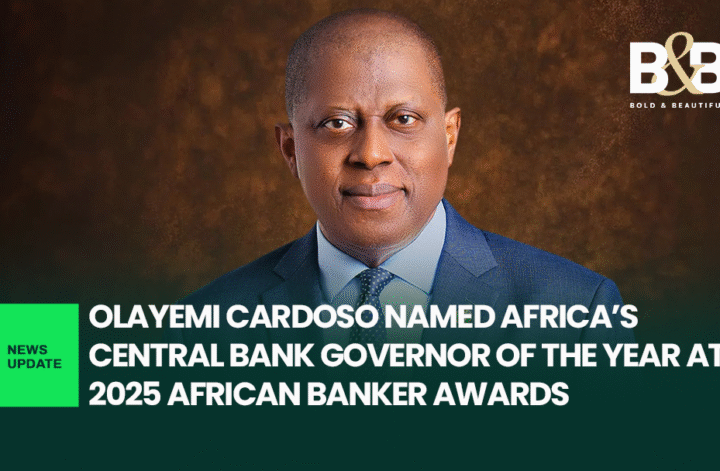

Nigeria’s Central Bank Governor, Olayemi Cardoso, was crowned Central Bank Governor of the Year at the prestigious 2025 African Banker Awards held in Abidjan, Côte d’Ivoire.

The honour, bestowed during a high-level gala last Wednesday, was a recognition of Cardoso’s “bold and strategic” reforms that have helped stabilise Nigeria’s financial system in one of its most challenging periods.

Award organisers, African Banker magazine, noted that Cardoso’s stewardship has been pivotal in restoring investor confidence, strengthening the naira, and re-establishing policy credibility through transparency and regulatory recalibration.

In a statement released by the Central Bank of Nigeria on Thursday, the Awards Committee highlighted the institution’s impact under Cardoso, specifically pointing to “key policy measures aimed at stabilising the naira, improving transparency in the foreign exchange market, and re-establishing policy credibility.” These, the Committee said, have laid the foundation for long-term macroeconomic resilience.

Accepting the award on his behalf was Dr Nkiru Balonwu, Adviser to the Governor. She was joined by Victor Oboh, Director of the Bank’s Monetary Policy Department, Olubukola Akinwumi, Director of the Banking Supervision Department, and Aloysius Uche Ordu, a member of the Monetary Policy Committee.

This year’s African Banker Awards, now in their 19th edition, were held in partnership with the African Development Bank Group, the official patron of the event. The ceremony continues to be a key fixture on the African financial calendar, celebrating innovation and leadership across the continent’s banking landscape.

Speaking on the award, the organisers noted, “The recognition reflects the Committee’s appreciation of Governor Cardoso’s firm leadership in tackling currency volatility and macroeconomic imbalances, and repositioning the Nigerian economy for sustainable growth.”

Since taking office, Cardoso has led a decisive monetary campaign marked by increased transparency in the FX window, strategic interest rate adjustments, and a shift towards data-driven policy making. The result has been a noticeable improvement in market confidence, even amidst global economic headwinds.