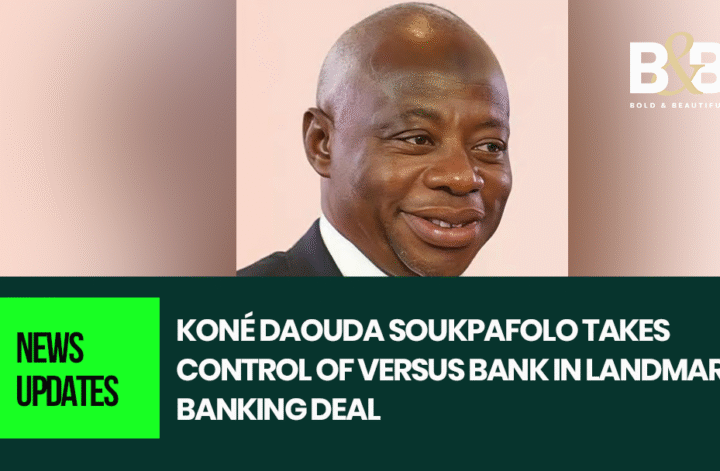

Koné Daouda Soukpafolo, the Ivorian businessman widely known as the country’s “cotton king”, has expanded his influence beyond agriculture by taking a controlling stake in Versus Bank. The acquisition marks a decisive shift in his investment strategy, moving from raw commodities into financial services.

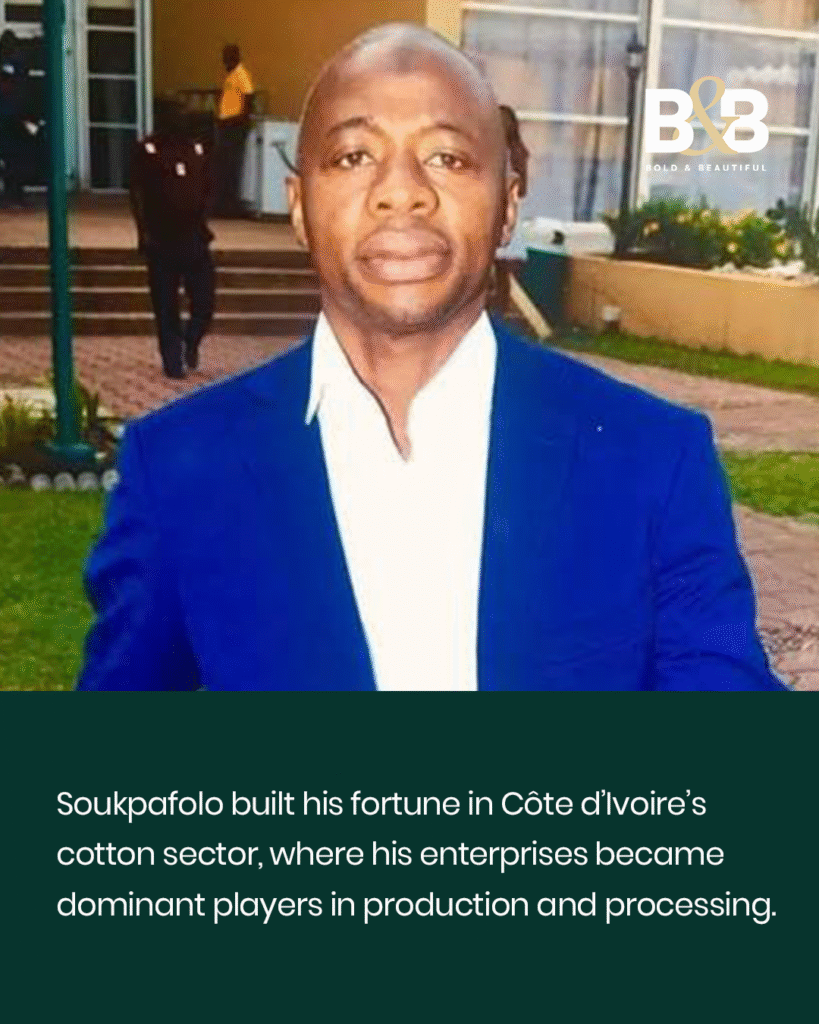

Soukpafolo built his fortune in Côte d’Ivoire’s cotton sector, where his enterprises became dominant players in production and processing. His entry into banking has been watched closely by financial analysts who see it as both a diversification play and a statement on the future of local capital in Ivorian finance.

Versus Bank, founded in 2004, has carved out a niche in corporate and SME banking. It has long been considered a strategic financial institution in Côte d’Ivoire, providing services to a mix of local businesses and regional investors. By securing majority control, Soukpafolo now has the ability to shape the bank’s growth trajectory and reposition it within the competitive West African financial market.

Details of the transaction have not been publicly disclosed, but sources in Abidjan confirm that Soukpafolo’s investment vehicle outbid regional competitors to secure the stake. The deal positions him as one of the few Ivorian entrepreneurs to hold such significant ownership in a domestic bank, a move likely to resonate across the private sector.

Observers note that the timing is crucial. Côte d’Ivoire has been experiencing steady GDP growth, with agriculture, mining and infrastructure driving expansion. The country’s banking sector is seeking deeper local participation, and Soukpafolo’s move answers long-standing calls for greater Ivorian control of financial assets.

Industry insiders say Soukpafolo plans to use his stake to expand Versus Bank’s lending capacity, with a focus on small and medium-sized enterprises that remain underserved despite strong demand for credit. The expectation is that his background in agribusiness will influence the bank’s credit strategy, with particular attention to agriculture value chains and rural development finance.

The acquisition also signals a generational shift in African capitalism. Soukpafolo represents a class of self-made entrepreneurs who have leveraged their success in traditional sectors to enter finance, technology, and infrastructure. By controlling a bank, he gains both financial leverage and influence over broader economic activity.

Versus Bank’s future under Soukpafolo will depend on how quickly he can scale operations and attract new capital. Regional competitors, particularly pan-African banks with stronger balance sheets, will test his ability to expand market share. His challenge will be balancing ambition with prudence in a sector that is heavily regulated and sensitive to macroeconomic shifts.

For Côte d’Ivoire, the transaction is symbolic. It underscores the rise of local investors capable of taking majority control of key institutions without relying on foreign consortiums. It also sends a signal to the region that Ivorian private capital is ready to compete in strategic sectors.

Soukpafolo has remained characteristically discreet about his long-term vision, but insiders suggest he sees banking as a platform for greater regional influence. If successful, his move could pave the way for further Ivorian-led acquisitions in West African finance.

The cotton magnate’s latest gamble is being hailed in Abidjan as more than a business deal. It is a demonstration of confidence in the domestic economy and a reminder that local ownership still matters in shaping Africa’s financial future.