Standard Bank Group Chief Executive, Sim Tshabalala, has announced a $1 billion commitment to finance and scale women-led businesses across Africa, marking one of the boldest private sector pledges ever directed at the continent’s female entrepreneurs.

For Africa’s banking sector, the figure is unprecedented. For women entrepreneurs, it represents a direct response to years of documented funding gaps. Studies from institutions including the African Development Bank show that women in Africa face a financing deficit estimated at more than $40 billion annually. Despite owning close to a third of the continent’s small and medium-sized businesses, women consistently receive less than 10 percent of commercial loans.

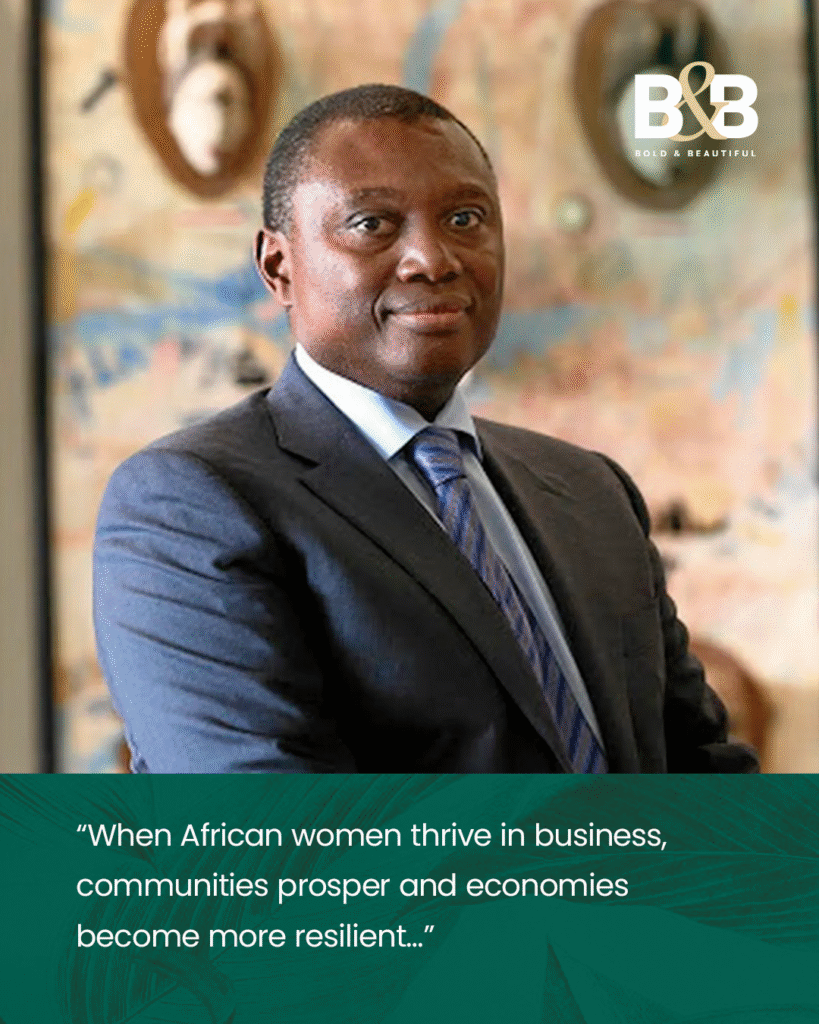

Tshabalala positioned the programme as a strategic investment, not philanthropy. “When African women thrive in business, communities prosper and economies become more resilient,” he told stakeholders at the unveiling. His framing reflects Standard Bank’s pivot toward sustainable finance and its long-stated ambition to back the sectors that underpin Africa’s growth story.

The $1 billion pledge is expected to be channelled into sectors where women entrepreneurs are most active and poised for expansion: agriculture, retail, healthcare, creative industries and digital technology. Beyond loans, the bank will extend mentorship and business development services, linking entrepreneurs to regional and international value chains.

Analysts say the move could recalibrate Africa’s investment landscape. “Capital has always been the greatest barrier for women entrepreneurs on the continent. If implemented at scale, this initiative could set the benchmark for gender-lens investing in Africa,” says Nkiru Okoye, a Lagos-based development finance specialist.

Standard Bank has been steadily building credibility in gender-focused finance. In 2019, it launched the Women in Business programme in South Africa, later expanding to Kenya, Uganda and Ghana. The $1 billion pledge represents the most significant escalation of that model to date, signalling a continent-wide strategy.

Tshabalala’s leadership has long balanced corporate growth with developmental imperatives. Since taking over as Group CEO in 2013, he has steered the bank through currency crises, global headwinds, and technology transitions, while keeping Africa at the core of its strategy. This latest commitment positions him not only as a banking executive but as one of the continent’s most influential voices in the push for inclusive economic growth.

The true test will be execution. African women entrepreneurs are watching closely for transparency in disbursement and accountability in delivery. If successful, the $1 billion programme could expand markets, strengthen supply chains, and catalyse jobs in some of Africa’s most dynamic yet underserved sectors.

For Standard Bank, the investment could also reshape its client base, deepening relationships with the fastest growing segment of Africa’s SME market. For the continent, it signals a shift in how seriously women’s enterprises are treated by mainstream finance.